One Man's Crash Is Another Man's Flash Sale

From the depths of the latest dip, opportunity springs anew!

Fear and greed are the two dominant emotions that drive markets, but when it comes to crypto, it seems like the threshold for both emotions is much higher. Not only are the peaks and drops felt more strongly, but also the market can alternate between extremes very quickly. Indeed, many newcomers, and some crypto veterans, were shocked this week as the market erased more than half a trillion dollars in one fell swoop.

Have we hit the bottom yet? And will Bitcoin recover? These two questions are currently on everyone’s minds, and we’ll try answering them with the help of some charts.

It’s easy to forget but Bitcoin experienced two similar corrections during the 2017 bull market in June and September of that year. On the last correction that year, Bitcoin dropped nearly 40% to below $3,000. Three months later, it peaked at $20,000.

Past performance is definitely not indicative of future results when it comes to any asset, let alone Bitcoin. But it is important to have the historical context in mind when it comes to Bitcoin as it helps overcome the rush of emotion and allows us to act from our head.

Ready to buy the dip? Head over to Coinmama!

We’ll be taking a data deep-dive to make sense of the dip later in this newsletter. But first, here are some narratives catalyzing crypto.

Elon’s hot, then he’s cold: With a one-word tweet, Elon Musk managed to achieve a unique feat of turning himself from Bitcoin’s hero to the newest villain on crypto Twitter. First he announced that Tesla would no longer accept Bitcoin as a payment method because it uses up too much energy. Later, Musk replied with the word ‘Indeed’ to a Twitter commentator’s suggestion that Tesla may have sold or are planning to sell their Bitcoin, sending the Twittersphere into a frenzy. He later clarified that this is not the case, but the damage had already been done. It’s highly unlikely that Musk did not consider Bitcoin’s energy consumption before buying $1.5 billion worth of the asset. In fact, some commentators have suggested that Musk is moving to draw attention to sustainable Bitcoin mining. Whatever his reasoning, it’ll soon be clear that Elon Musk needs Bitcoin more than Bitcoin needs Elon Musk.

Welcome to inflation: While all eyes were focused on the dropping Bitcoin price, new inflation statistics from around the world are validating Bitcoin’s main thesis as a hedge against the devaluation of currency. In the US, inflation hit a 13 year high, reaching 4.2% when compared to last year. That’s more than double the Fed’s targeted rate of 2%. Countries like the UK and South Africa are also experiencing high inflation rates as the purchasing power of fiat continues to decline around the world.

DeFi hacks are increasing, stay safe out there: The decentralized finance (DeFi) space has contended with hacks since the very beginning, but hacking activity has grown alongside this multi-billion dollar sector over the past 18 months. A sample of the hacks from the past few weeks includes Rari Capital, Spartan DeFi and EasyFi which were hacked for $10m, $30m and $80m respectively. DeFi hacks range from smart contract vulnerabilities to inside jobs and social engineering. The fact that DeFi projects integrate so tightly with one another means that the risk of attack can spread from the least-secure applications and create a ‘lego effect’ across the space.

Coinmama Updates

We let the Doge out! Dogecoin has been making waves worldwide and is now available on Coinmama. We’re excited to allow Coinmama customers to participate in this exciting era of meme investing.

We’ve enabled Google Pay support, so now you have even more payment methods to choose from, and even fewer excuses to make for not completing your order.

US customers can now sell Bitcoin directly into their bank account using Fedwire.

A Data-Driven Look At Crypto’s Latest Dip

Bitcoin was sitting on $45,000 after experiencing a sharp 25% drop from all-time highs on Tuesday the 18th of May 2021 when the markets started to behave eerily similar to March ‘20. Back then, COVID was just starting and the resulting economic uncertainty and closure drove global markets into a tailspin. Now, all it took was a few tweets from Elon Musk and some recycled FUD from China to bring the market to its knees.

In the graph below, we can see the total funds that flowed into exchanges hitting highs not seen for over a year. Exchange inflows, shown in the green, shows money is flowing from longer-term storage into exchanges, which suggests that selling is about to begin. With Bitcoin already down 25%, the exchange inflows on May 18th strongly indicated that the price had to make another leg down before finding bottom. Thankfully, the inflow into exchanges has stopped, suggesting that heavy selling has abated.

In terms of the technical indicators, Bitcoin has reached oversold levels not seen since March ‘20. The Relative Strength Index (RSI), an indicator that measures the momentum of an asset, dropped below 30 indicating extreme oversold conditions. Furthermore, Bitcoin dropped below its 200 day moving average for the first time in over a year, further strengthening the bear case.

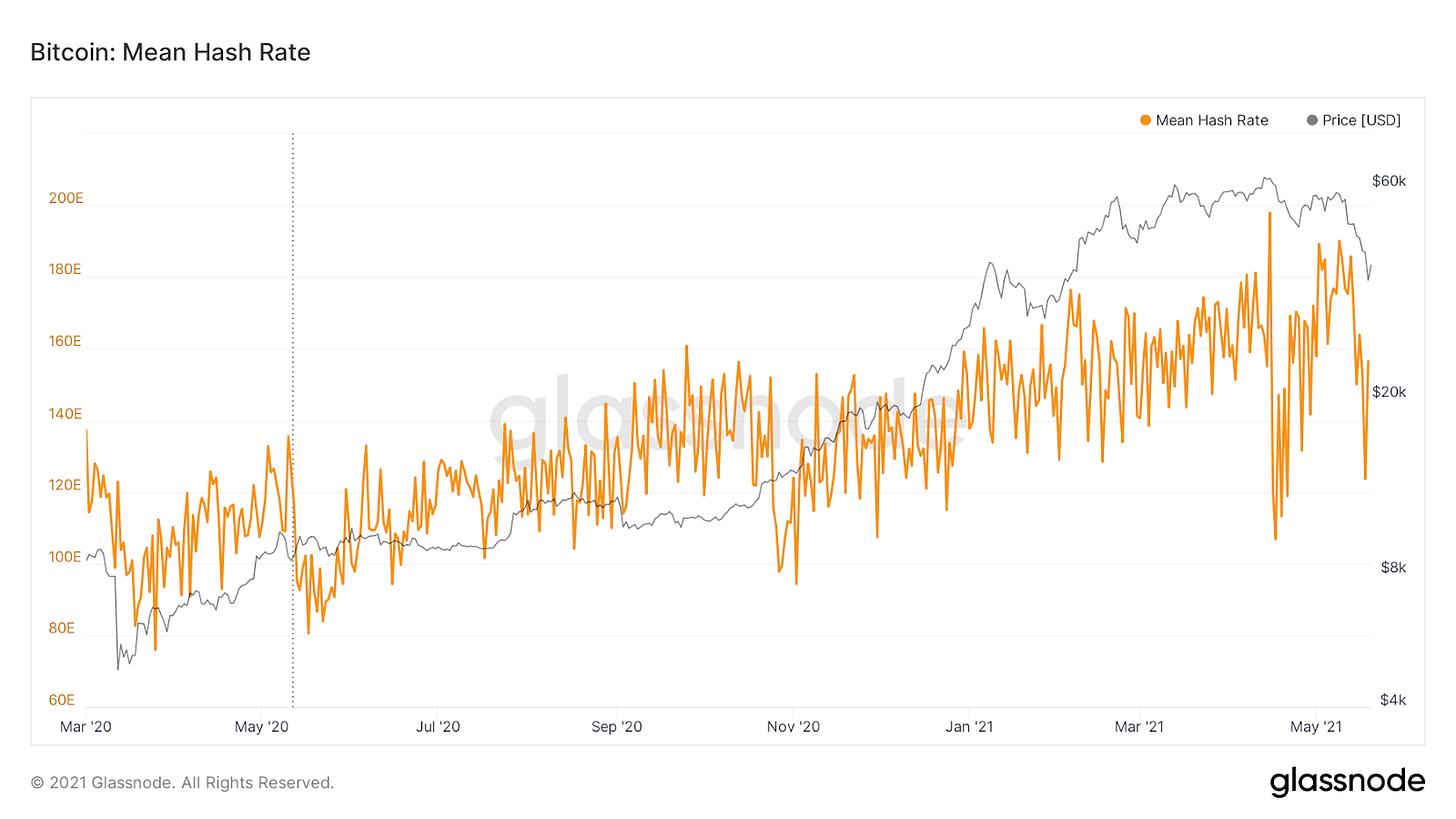

The combination of the oversold technical indicators and the end of exchange inflows suggests that Bitcoin is close to finding a bottom. This is strengthened by the fact that the Bitcoin hash rate made a strong rebound, jumping 27% yesterday alone. The hash rate measures how much electricity miners are putting in to secure the network. With the price dropping throughout the week, Bitcoin became less profitable to mine which caused miners to shut off their machines and hash rate to drop. Although it would be nice to see it sustained for a few more days, the quick rebound suggests that Bitcoin has become attractive to mine once again.

FUD? FOMO? Wealth Grow!

In a recent interview with Authority Magazine, our co-founder Laurence Newman made the point that Bitcoin is not about getting rich quick, it’s about setting people free. Shifting to Bitcoin is an exercise in releasing oneself from the greed-infused consumption habits of the fiat economy and instead accumulating sound money steadily and consistently.

We get it, these dips are painful to experience. But generational wealth is forged out of steel hands and a cool, calm conviction.

Keep calm and HODL on!